Customer Payment with VIRA

Participated in discovery sessions with the client, collaborating with the Product Lead to identify user and business goals

Audited the existing MVP mockups to identify usability and experience improvement opportunities, and conducted desk research on similar digital products

Supported project planning and roadmap alignment with stakeholders

Created wireframes for key user flows and iterated based on feedback

Participated in the creation of UI designs

Our client had structured a payments solution that allowed underserved merchants and customers to access financial services. The solution enabled customers to purchase a single-use virtual card that required activation and could be used at associated merchants without sharing card details, while high-risk merchants could reliably accept payments.

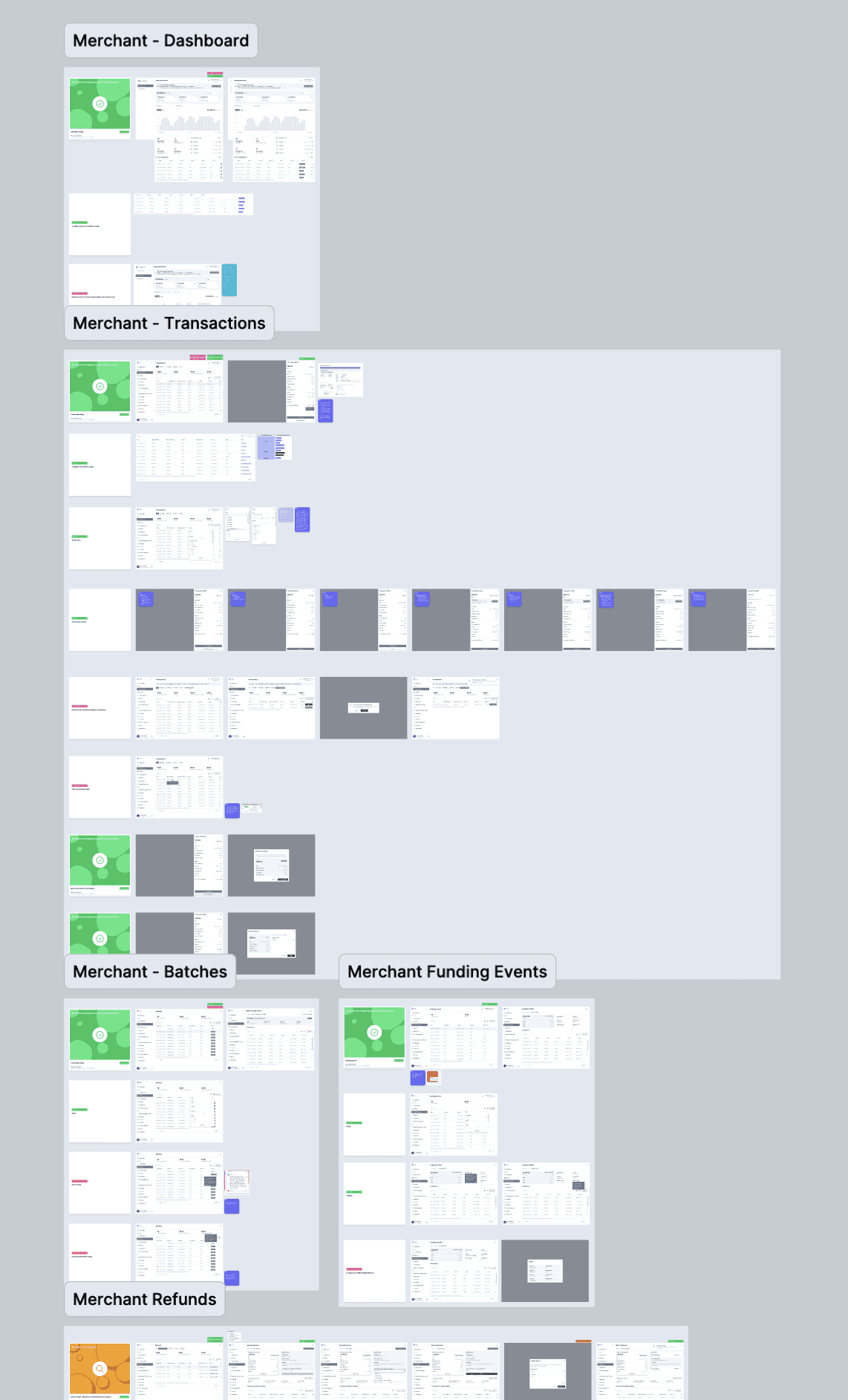

Screenshots from the previously implemented MPV

Since the business model was already validated, our design challenge was to translate this solution into a simple, clear, and trustworthy user experience. We needed to ensure that key flows were intuitive and transparent, creating an experience that balanced trust, usability, and compliance. This was achieved through a clean interface, consistent visual cues, and friendly, clear copy.

We focused on creating an end-to-end solution that allowed customers to purchase, activate and complete an order checkout at participating merchants, while merchants could receive and track payments, as well as manage refunds and disputes.

Customer Platform - Transactions screen

Merchants: Accept payments securely, manage transactions and disputes efficiently, and operate in compliance with financial regulations while maintaining customer trust.

Customers: Pay safely, track balances and transactions, and navigate purchases and disputes easily while feeling confident in the platform.

We defined high-level user stories to outline key goals for both customers and merchants. Based on these, we created an initial work breakdown structure (WBS) to organize tasks, estimate effort, and align the design scope.

Sitemaps helped establish the foundation for the customer and merchant platforms, defining clear paths for the dashboard overview, transaction management, virtual card purchases and activations, and account and support sections.

I created wireframes to define the key flows and tasks for both merchants and customers. These included:

Customer flows:

Purchase and activate a single-use virtual card

Checkout and payment at participating merchants

View transaction history and balances

Request refunds and manage disputes

Merchant flows:

Receive and track payments

Review sales performance and analytics

Process refunds and handle disputes

Once wireframes were validated, I helped create high-fidelity UI designs, applying the design system developed by our UI designer.

Customer portal

Merchant portal

Following the completion of the main flows, the flows and wireframes for dispute management were finalized, ready to guide the UI design phase. The next feature to focus on was the merchant marketing section, allowing merchants to create offers and promotions for customers within the platform.